- Home

- Plumbing

- Heating

- Heating Installation

- Heating Repair & Service

- Ductless Heating

- Heat Pumps

- Geothermal Heating

- In-floor Heating

- Energy Savings

- Financing

- Duct Sealing

- Duct Cleaning

- Turn Me On Early

- Mass Save Rebates

- Healthy Home Services

- Pool Heating

- 2025 EPA Refrigerant Regulations

- Heating Maintenance

- Furnace Giveaway!

- Cooling

- Electrical

- Remodels

- Guarantee

- Areas

- Reviews

- Maintenance Plans

- Careers

- Call Us

Your Mass Save Rebate Partner in Massachusetts

Navigating rebates, financing, eligibility rules, and paperwork can feel overwhelming.

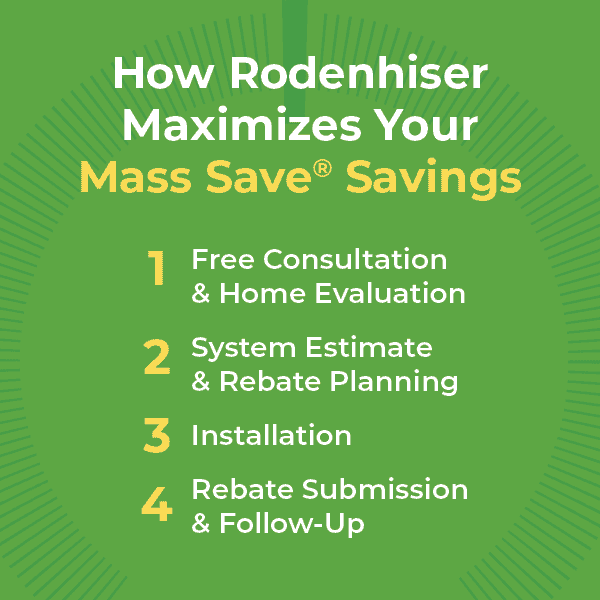

Rodenhiser simplifies the entire process. As a Mass Save Heat Pump Installer Network contractor, we guide homeowners through:

-

Free rebate eligibility reviews

-

System design that maximizes incentives

-

HEAT Loan Guidance & Recommendations

-

Professional installation

-

Rebate submission and tracking

From quote to rebate check, we handle the details — so you can focus on comfort.

Rebates for heating and A/C systems are significant! If you install a qualifying heat pump, you may be eligible to receive up to $8,500 in rebates.

Financing and rebate offers are available for a limited time for high efficiency heat pumps only!

2026 Air Source Heat Pump Rebates

There are three types of rebates: Whole-home, Partial-home and Basic. The type of rebate you are eligible for depends on whether you use your heat pump as the sole source for heating and cooling your home, or as a supplement to an existing system. Rebates are offered based on equipment size (tonnage).

| Rebate Type | Rebate Amount |

|---|---|

| Whole-Home | $2,650 per ton* up to $8,500 |

| Partial-Home | $1,125 per ton up to $8,500 |

| Basic | $250 per ton up to $2,500 |

| Income-Based Enhanced Incentives | Up to $16,000 or up to no cost through Turnkey Services |

Tons are calculated based on AHRI cooling capacity divided by 12,000 BTUs. Rebate amount based on tons.

Pre-existing fuel type must be oil, propane, or electric resistance.

Whole-home rebates are available to customers who install heat pumps as the sole source for heating and cooling.

Basic rebates are available to customers who are NOT displacing fossil fuel or electric resistance heat in their home. These scenarios include, but are not limited to:

- Updating an existing heat pump or central air conditioning system

- Installing a heat pump in a previously unconditioned space (e.g., new addition)

- Installing a heat pump in a home that is not occupied in the winter (e.g., summer home)

Air to Water Heat Pumps

Air to water heat pumps can provide a total solution for heating, cooling, and hot water supply in a home.

Air to water heat pumps use the same concept as an air source heat pump for drawing out heat from the outdoor air. The difference is it delivers the heat via water piped through a home (rather than hot air).

| Equipment Type | Efficiency Requirements | Rebate Amount | Enhanced Amount (Income-Based)1 |

|---|---|---|---|

| Air to Water Heat Pump | Refer to the MassSave.com/HPQPL | $2,650 per ton up to $8,500 | Up to $16,000 |

Mass Save Program FAQ

Mass Save rebates in 2026 can offer Massachusetts homeowners thousands of dollars in savings — depending on whether you install a whole-home or partial-home system.

At Rodenhiser, we don't just quote a system — we calculate your maximum eligible rebate before installation. As a Mass Save Heat Pump Installer Network contractor, we:

- Confirm your home qualifies

- Design the system to meet rebate thresholds

- Ensure equipment meets program requirements

- Submit rebate paperwork on your behalf

Our goal is simple: help you receive every dollar you qualify for — without the confusion or wait.

Schedule a free consultation and rebate review with Rodenhiser.

In most cases, yes. A Home Energy Assessment is required to qualify for certain Mass Save rebates and HEAT Loan financing.

Rodenhiser coordinates this process for you. We:

- Confirm whether you already have a valid assessment

- Help schedule one if needed

- Review insulation and weatherization recommendations

- Ensure nothing delays your rebate approval

Many homeowners don’t realize that missing this step can delay or reduce rebates. We make sure it’s handled correctly from the start.

The Mass Save HEAT Loan offers 0% interest financing for eligible heating and air conditioning upgrades.

When you work with Rodenhiser, we:

- Prepare the required contractor proposal

- Provide the documentation needed for lender approval

- Guide you through participating banks

- Ensure your project qualifies before installation begins

We can help guide homeowners to participating banks to where they can secure financing before work starts, so there are no surprises.

Yes — many Massachusetts homeowners can stack:

- Mass Save heat pump rebates

- 0% HEAT Loan financing

- Federal energy efficiency tax credits

Rodenhiser reviews all available incentives during your quote appointment and shows you the combined savings clearly — not just the equipment price.

We believe homeowners deserve to understand:

- True installed cost

- Net cost after rebates

- Total value of your high efficiency heating or air conditioning system

Mass Save processing times can vary depending on documentation and program volume.

The most common reason for delays? Incomplete or incorrect submissions.

When Rodenhiser installs your system, we:

- Submit required paperwork accurately

- Ensure serial numbers and AHRI matches meet program guidelines

- Follow up if additional documentation is needed

Our team has processed hundreds of rebate applications — we know how to prevent delays before they happen.

Not all HVAC companies are Mass Save Heat Pump Installer Network contractors — and not all contractors actively manage rebate compliance.

Rodenhiser is a trusted Mass Save partner serving Massachusetts homeowners for decades. When you work with us, you get:

- Expert system design for Massachusetts winters

- Cold-climate heat pump expertise

- Upfront rebate calculations

- Direction with HEAT Loan applications

- Professional installation

- Full rebate submission support

- Local service and long-term support

We don’t just install equipment — we manage the entire incentive process.

Read From Over 14,000 Happy Customers

-

Both Alex and Patrick were knowledgeable, courteous, and professional. They made a change that might have solved the recent problem and have structured a more complete solution. We agreed to this...

-

Mike was thorough, thoughtful and considerate. Covered their shoes before entering, surveyed my issue and provided an explanation of the services and costs. Great Job!

-

Alex did a great job providing an explanation of the services provided and went out of his way to offer assistance/advice on other issues outside of our scheduled maintenance visit.

-

Brian did an excellent job inspecting our 18-year old boiler and replacing some of the accessory hardware that needed it, he also adjusted the outgoing hot water settings for our radiators and...

-

Rodenhiser is my one stop shop!!! They take care of my HVAC, electrical, and plumbing issues & are always helpful addressing any questions I may have about the systems in my house! Everyone...

-

Chris G. and Nick V. showed up bright and early at 8am to fix my water heater issue. They were on time, polite and were able to fix an issue that has been plaguing my house for a good year. They...

Call Rodenhiser at

1-800-462-9710

Call Rodenhiser at 1-800-462-9710

When you are looking for plumbing, electrical, heating or air conditioning in the Route 495 / 128 area, you will be delighted that you called Massachusetts' trusted choice since 1928.

With a total dedication to professional workmanship and excellent service, discover why families and businesses continue to trust Rodenhiser after generations of service

Trusted Plumbers

Fast, On Time

HVAC Experts

Satisfaction Guaranteed

Expert Electricians

Maintenance Plans

Special Financing with Rodenhiser

APPLY ONLINE

for Financing Through Wells Fargo

*With Approved Credit. Terms and Conditions Apply.

CONTACT RODENHISER TODAY

325 Hopping Brook Rd Holliston MA 01746.

-

Master Plumber: #10961

-

Corporate Plumbing: #2288

-

Master Electrician: #23917A

-

Electrical Business: #4804

-

Master Sheet Metal (Unrestricted): #5867

-

Corporate Sheet Metal: #641

-

Home Improvement Contractor: #188806

*Heating system check terms and conditions: Residential Only. Must reside within our service area. Offer only available to 1 unit per household additional units are at full price. Can not be combined with other offers

*Late Season Special Extra Conditions: Gas Systems only. No Discounts on oil systems. Promotional price limited to one system per home, additional systems will be charged at full price. Residential Systems only. Must reside within our service area. *For EV Charger Offer also: valid only when the system is purchased through Rodenhiser.